Crypto market volatility

The cryptocurrency market is notoriously volatile, experiencing wild price swings that can leave inexperienced investors reeling.

This volatility stems from a combination of factors, including regulatory uncertainty, technological advancements, and the speculative nature of the market.

Understanding these factors is key to navigating the risks and potential rewards of crypto investing.

Thank you for visiting Cryptomomen.com

Importance of understanding and predicting volatility

Understanding and predicting the volatility of cryptocurrency is essential for successful trading and investment.

By analyzing market trends, technical indicators, and news events, traders can gain insights into potential price fluctuations.

Volatility can provide opportunities for profit but also poses risks.

Accurate predictions allow traders to adjust their strategies, set stop-loss orders, and mitigate potential losses.

Historical data, moving averages, and Bollinger Bands are some tools that can assist in this process.

Understanding the factors that drive volatility, such as regulation, supply and demand, and market sentiment, is crucial for informed decision-making.

Types of Crypto Volatility

Understanding cryptocurrency volatility is crucial for investors. Volatility refers to the fluctuations in the price of a cryptocurrency over time.

It can be measured using various metrics, such as the standard deviation or the beta coefficient.

High volatility can indicate both potential for gain and loss, while low volatility suggests a more stable asset.

Market analysis plays a significant role in assessing volatility, involving the study of historical price data, market trends, and external factors that may impact the cryptocurrency’s value.

By understanding the types and causes of volatility, investors can make informed decisions about their cryptocurrency investments and manage their risk exposure effectively.

Historical volatility

Historical volatility, a measure of the price swings in a cryptocurrency over time, is a crucial indicator for market analysts.

This metric, expressed as an annualized percentage, captures the magnitude and frequency of price fluctuations, enabling traders to assess the risk and potential rewards associated with investing in a particular digital asset.

Understanding historical volatility can help investors make informed decisions and adjust their trading strategies accordingly.

Implied volatility

Implied volatility (IV) is a crucial metric in cryptocurrency market analysis, reflecting the expected volatility of a cryptocurrency’s price over a certain period.

It is derived from the prices of options contracts and provides traders with insights into market sentiment and potential price movements.

By analyzing historical IV patterns, traders can identify overvalued or undervalued options and make informed decisions about their trading strategies.

Measuring Crypto Volatility

Volatility is an intrinsic characteristic of the cryptocurrency market, making it crucial for investors to understand and measure its impact on their investments.

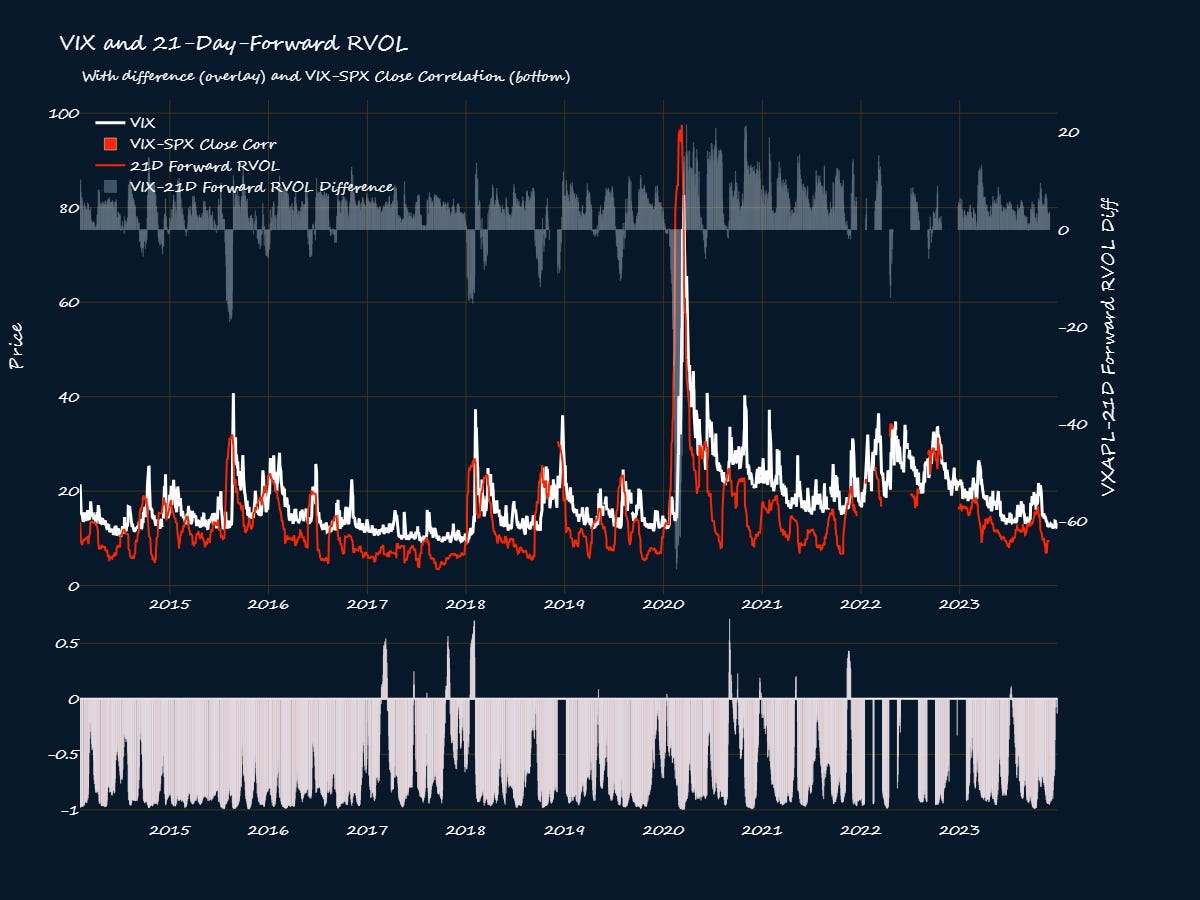

While traditional financial markets employ measures like standard deviation and the VIX index, the cryptocurrency realm presents unique challenges due to its decentralized nature and varying trading volumes.

One common approach to quantifying crypto volatility is the Bollinger Bands indicator, which plots the market’s movement within two standard deviations of a simple moving average.

Additionally, the Relative Strength Index (RSI) assesses overbought and oversold conditions by comparing the magnitude of recent gains to recent losses. Value at Risk (VaR) models are also used to estimate the potential maximum loss over a given time period, providing insights into the worst-case scenarios.

By incorporating these metrics into their analysis, investors can make informed decisions, assess the risk-reward balance, and optimize their trading strategies in the ever-evolving crypto market.

Statistical methods

Statistical methodologies play a pivotal role in Cryptocurrency Volatility and Market Analysis.

They quantify market trends, measure risk, and enhance predictive capabilities.

Time series analysis, Bayesian inference, and machine learning algorithms are commonly employed to analyze volatility patterns, identify market anomalies, and develop trading strategies.

By leveraging statistical methods, investors and analysts gain insights into market dynamics, enabling informed decision-making and risk management.

Technical analysis

Technical analysis plays a crucial role in understanding the volatility of cryptocurrency markets.

By studying historical price data, patterns, and indicators, analysts can identify potential trading opportunities.

This involves analyzing market trends, support and resistance levels, and chart patterns to make informed decisions.

The goal is to predict price movements and market reversals by interpreting the data and identifying patterns that suggest future price behavior.

Technical analysis is a complex but valuable tool for cryptocurrency traders, offering insights into market sentiment and helping to mitigate risk.

Closing Words

In conclusion, navigating the volatile landscape of cryptocurrencies requires a multifaceted approach.

By understanding the key drivers of volatility, employing risk management strategies, and utilizing data analytics, investors can navigate the inherent uncertainty and capitalize on potential opportunities.

As the crypto market continues to evolve, it is crucial to stay informed and adapt to the ever-changing conditions.

With a combination of knowledge, discipline, and a long-term perspective, investors can harness the transformative power of cryptocurrencies while mitigating the associated risks.

Remember, knowledge is power, and the more you know about crypto volatility, the better equipped you’ll be to make informed decisions.

Until next time, stay tuned for more insightful crypto explorations. Don’t forget to share this article with your fellow crypto enthusiasts, and thank you for joining us on this journey of understanding the crypto rollercoaster!