What is Cardano Staking?

Cardano Staking offers investors the opportunity to earn passive income by delegating their ADA to stake pools that contribute to the network’s security and operations.

By participating, stakers receive regular rewards proportional to the amount of ADA they stake and the pool’s performance.

Cardano’s proof-of-stake consensus mechanism ensures a secure and sustainable blockchain while rewarding participants for their contributions to the network’s growth and stability.

Thank you for visiting Cryptomomen.com

Benefits of Staking ADA

Staking ADA, the native cryptocurrency of the Cardano blockchain, provides numerous benefits for holders.

By participating in the proof-of-stake consensus mechanism, stakers contribute to the network’s security and stability while earning rewards in the form of new ADA tokens.

Staking requires minimal effort, with ADA holders simply delegating their tokens to a reputable stake pool through a compatible wallet.

The pool’s operators maintain the necessary infrastructure and handle the staking process on behalf of the delegators, who earn a share of the pool’s rewards proportional to their stake.

Staking ADA offers a passive income stream, governance rights, and supports the growth and development of the Cardano ecosystem.

How to Stake ADA

Cardano (ADA) staking is a secure and rewarding way to earn passive income while supporting the Cardano network.

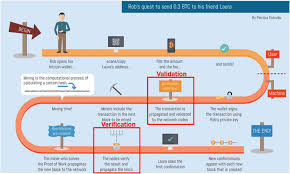

When you stake ADA, you are essentially lending your tokens to the network, which uses them to validate transactions and secure the blockchain.

In return, you receive staking rewards, which are paid out proportionally to the amount of ADA you have staked and the length of time you have staked it.

Staking ADA is a relatively low-risk way to earn cryptocurrency rewards, and it can be a great way to generate passive income.

To stake ADA, you will need to delegate your tokens to a staking pool.

There are many different staking pools available, so it is important to do your research and choose a reputable pool.

Once you have chosen a pool, you can delegate your ADA to it by following the instructions on the pool’s website.

The minimum amount of ADA required to stake varies from pool to pool, but it is typically around 100 ADA.

Staking rewards are typically paid out monthly, and the APY (annual percentage yield) for staking ADA varies depending on the pool you choose.

However, it is not uncommon to earn an APY of 5-10%. Staking ADA is a great way to earn passive income and support the Cardano network.

If you are interested in learning more about staking ADA, there are many resources available online.

Choosing a Cardano Staking Pool

The best Cardano staking pool selections are: Emurgo, Binance, Kraken, Coinbase, and KuCoin.

Staking involves committing ADA coins to a pool in exchange for rewards.

When assessing pools, look at fees, pool size, saturation level, performance history, and operator’s reputation.

For beginners, larger pools with lower fees may be more suitable.

Monitoring Your Staked ADA

To maximize returns from Cardano staking, it’s crucial to actively monitor the performance of your staked assets.

This involves tracking several key metrics, including:

- Pool Performance: Assess the health and profitability of the staking pool you have delegated to. Check its historical performance, block production rate, and fees to ensure it aligns with your expectations.

- Rewards: Regularly review the rewards you earn as a delegator. They vary based on the pool’s performance and the amount of ADA you have staked. Monitoring rewards ensures you’re receiving the returns you’re entitled to.

- Security: Monitor the security of your staked ADA. If the pool you have delegated to experiences technical issues or vulnerabilities, it may impact your assets. Stay informed about any security updates or concerns to mitigate potential risks.

Unstaking ADA

When unstaking ADA, users can withdraw their staked funds from a staking pool and regain control over their assets.

To unstake ADA, users must first navigate to the staking dashboard on their chosen platform.

They can then select the pool they have staked their ADA in and click the “Unstake” button.

The unstaking process typically takes several epochs (approximately 5 days) to complete.

Once the unstaking period is over, users can withdraw their ADA and any accumulated rewards.

Risks of Staking ADA

Cardano (ADA) staking involves delegating ADA to a stake pool to earn rewards.

While this can be a passive way to generate income, there are also associated risks.

These include the possibility of impermanent loss if the value of ADA fluctuates significantly, the risk of losing rewards if the stake pool underperforms, and the potential security risks associated with delegating to a third-party pool.

Additionally, staking ADA requires a minimum stake amount and can incur fees for delegation and withdrawal.

It’s crucial to carefully consider these risks before committing to staking.

Conclusion

Cardano staking offers an attractive means to earn rewards while contributing to the network’s security.

To participate, users delegate their ADA to staking pools operated by pool operators who manage the technical aspects of maintaining the blockchain. The rewards are distributed proportionally to the amount of ADA staked and the pool’s performance. Questions (FAQs) often arise about Cardano staking:

- How much can I earn from staking?

- Earnings vary based on the size of your stake and the pool’s performance, typically ranging from 5% to 10% annually.

- Is staking safe?

- Staking itself is considered safe, as your ADA is not moved out of your wallet. However, the security of your wallet is crucial in preventing potential loss.

Hope it is useful

In conclusion, Cardano staking offers a passive and accessible way to participate in the secure operation of the blockchain, while earning rewards for your contributions.

By selecting a reputable staking pool, you can delegate your ADA to trusted operators who will maintain the network infrastructure and process transactions.

The rewards earned are proportional to the amount of ADA staked and the performance of the pool.

Whether you’re a seasoned investor or a crypto enthusiast, Cardano staking presents an excellent opportunity to support the growth and development of this innovative blockchain platform while generating passive income.

Remember to share this informative piece with your friends and stay tuned for more intriguing articles.

Thank you for delving into the captivating world of Cardano staking!