Cryptomomen.com – In the realm of investment, the debate between the allure of traditional gold and the enigmatic rise of Bitcoin has captivated investors worldwide. Each asset boasts distinct characteristics that may align with varying investment goals.

While the enduring appeal of gold as a haven asset and store of value cannot be denied, the meteoric ascent of Bitcoin as a volatile yet potentially lucrative digital currency has turned heads.

This article delves into the complexities of these asset classes, exploring their historical performance, potential risks and rewards, and key considerations for investors seeking to navigate the ever-evolving investment landscape.

Please continue reading as we dissect the intricacies of Gold vs.

Bitcoin, empowering you to make informed choices that align with your unique financial objectives.

Importance of diversification

Diversifying your portfolio is essential for reducing risk and maximizing returns.

One effective way to diversify is by investing across different asset classes, such as Bitcoin and gold.

Bitcoin, a decentralized digital currency, offers exposure to a growing and volatile market with potential for high returns.

Gold, a precious metal with a long history as a store of value, provides stability and protection against inflation.

By combining these two investments, investors can balance risk and reward, creating a more resilient portfolio that can withstand market fluctuations.

Thank you for visiting Cryptomomen.com

Overview of gold and Bitcoin as investment options

Gold and Bitcoin, two distinct asset classes, offer investors varying opportunities.

Gold, a traditional safe haven, has historically provided stability and potential inflation protection, while Bitcoin, a cryptocurrency, has garnered interest as a speculative investment with high volatility.

Investors should consider their risk tolerance, time horizon, and financial goals when evaluating these options.

Historical Performance

Over the past decade, Bitcoin and gold have emerged as compelling investment alternatives.

While Bitcoin has experienced exponential growth, gold remains a safe haven asset with a long-standing track record.

However, comparing their historical performance is challenging due to Bitcoin’s short existence compared to gold’s millennia-long history.

Gold’s long-term value preservation

Gold has long been considered a safe haven asset due to its intrinsic value and historical stability.

In times of economic uncertainty or geopolitical turmoil, investors often flock to gold as a means of preserving their wealth.

Unlike fiat currencies, which are subject to devaluation and inflation, gold retains its purchasing power over the long term.

Moreover, physical gold is a tangible asset that can be easily stored and transported, making it a desirable option for those seeking a secure store of value.

While Bitcoin has emerged as a potential alternative to gold, its history is much shorter, and its value is subject to significant volatility.

Ultimately, the choice between gold and Bitcoin for long-term value preservation depends on an individual’s risk tolerance and investment goals.

Bitcoin’s recent volatility

Amidst the fluctuations of Bitcoin’s value, investors seek refuge in the stability of gold.

While Bitcoin offers potential for high returns, its volatility poses risks.

Gold, on the other hand, has historically maintained its value, making it a safer option for those seeking long-term stability.

Risk vs. Reward

Investing in Bitcoin or gold involves inherent risks and rewards. Bitcoin, a volatile cryptocurrency, offers potential for high returns but also carries significant risks of market fluctuations and cyber threats.

Conversely, gold, a traditional safe haven asset, provides stability and diversification but offers lower potential for growth. Understanding these risks and rewards is crucial for making informed investment decisions.

FAQs:

- Q: Which is more risky, Bitcoin or gold?

- A: Bitcoin is generally considered more risky than gold due to its volatility and lack of underlying physical assets.

- Q: Which has higher potential for returns?

- A: Bitcoin has the potential for higher returns but also carries greater risks.

- Q: Is it wise to invest in both Bitcoin and gold?

- A: Diversifying investments by holding both assets can help mitigate risks while potentially enhancing returns.

Gold’s lower risk profile

Gold, with its low volatility and inverse correlation to risk assets, offers a buffer against market fluctuations.

Its tangible nature and historical performance as a safe haven asset have made it a desirable investment amidst economic uncertainty.

In contrast, Bitcoin’s high volatility and speculative nature expose investors to greater risk.

While Bitcoin may offer potential returns, its lack of intrinsic value and regulatory challenges make it a less stable investment compared to gold’s lower risk profile.

Bitcoin’s potential for higher returns

Bitcoin as an investment has the potential for higher returns compared to traditional investments like gold.

It is a decentralized digital currency, making it immune to centralized control and manipulation.

Bitcoin exhibits high volatility, leading to potential gains and losses.

However, long-term studies suggest that it has outperformed gold in terms of returns.

Bitcoin’s scarce supply and growing adoption contribute to its price appreciation.

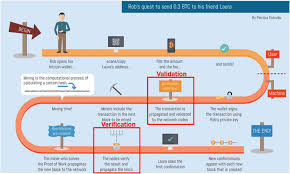

To invest in Bitcoin, consider the following steps: 1. Open an account: Create a cryptocurrency exchange account.

- Select exchange: Choose a reputable exchange that supports Bitcoin trading.

- Fund your account: Transfer funds from your bank account or credit/debit card.

- Place an order: Specify the amount of Bitcoin you want to buy and the price you are willing to pay.

- Monitor your investment: Track the performance of your Bitcoin investment and adjust your strategy as needed.

Closing Words

In conclusion, the choice between gold and Bitcoin as an investment depends on individual risk tolerance, investment horizon, and financial goals.

Gold has historically been a safe-haven asset, providing stability during market turmoil.

Bitcoin, on the other hand, offers potentially higher returns but also carries more risk due to its volatility.

Consider your financial situation and investment objectives carefully before making a decision.

Both gold and Bitcoin have their place in a diversified portfolio, but the optimal allocation will vary depending on your unique circumstances.

Until next time, thanks for reading and don’t forget to share this article with your friends!