Introduction to DeFi

DeFi (Decentralized Finance) is a rapidly growing ecosystem of financial applications built on blockchain technology.

It aims to create a more open, accessible, and transparent financial system by eliminating intermediaries and empowering users with control over their own assets. DeFi offers a wide range of services, including lending, borrowing, trading, and asset management.

By leveraging the liquidity of cryptocurrencies, DeFi platforms can provide users with access to financial products and services that are not available through traditional financial institutions.

FAQ:

- What is the difference between CeFi and DeFi?

- CeFi (Centralized Finance) refers to traditional financial institutions, while DeFi operates on decentralized platforms.

- Is DeFi safe?

- DeFi protocols are built on secure blockchain technology, but it’s important to remember that the underlying assets (cryptocurrencies) can be volatile.

- How can I get started with DeFi?

- You can access DeFi platforms through a cryptocurrency wallet and connect to a decentralized exchange (DEX).

- What are the benefits of using DeFi?

- DeFi offers higher returns, lower fees, and increased transparency compared to traditional financial services.

Thank you for visiting Cryptomomen.com

The role of liquidity pools and yield farming in DeFi

DeFi (Decentralized Finance) relies heavily on liquidity pools, which aggregate funds from multiple users to facilitate asset trading.

Yield farming encourages users to deposit their assets into these pools by offering rewards, increasing liquidity and stability.

However, this also carries risks, such as impermanent loss and rug pulls, where malicious actors abscond with funds.

To mitigate these risks, DYOR (Do Your Own Research) and invest only what you can afford to lose.

Understanding Crypto Liquidity Pools

Crypto liquidity pools are vital components of decentralized finance (DeFi), enabling seamless trading and price discovery.

These pools aggregate liquidity from numerous participants, creating a deep and liquid market for cryptocurrencies.

By providing a continuous source of liquidity, liquidity pools enhance market efficiency, reduce price volatility, and facilitate the growth of DeFi ecosystems.

They empower traders to execute orders quickly and efficiently, ensuring a more stable and reliable trading experience.

Definition of liquidity pools

In the realm of decentralized finance (DeFi), liquidity pools are vital components that facilitate seamless cryptocurrency trading.

These protocol-controlled virtual spaces maintain reserves of tokens, enabling users to trade without relying on traditional order books.

Unlike centralized exchanges, liquidity pools rely on automated market makers (AMMs), algorithms that determine token prices based on their relative supply and demand.

To participate in a liquidity pool, users deposit equal amounts of two tokens into the pool, becoming liquidity providers.

In return, they receive liquidity pool tokens representing their share of the pool’s reserves and earn trading fees generated by trades executed through the pool.

How liquidity pools work

Liquidity pools in decentralized finance (DeFi) operate on the principle of automated market making (AMM).

Users deposit their crypto assets into a shared pool, which creates a market for trading pairs.

The constant product formula (x * y = k) ensures that the ratio of assets in the pool remains constant, thereby providing liquidity and enabling trades at any time.

Traders can swap assets between the pools, and the price of each asset is determined by the supply and demand within the pool.

Liquidity providers earn fees for contributing to the pool and facilitating trades.

Benefits of providing liquidity to a pool

Providing liquidity to a pool in decentralized finance (DeFi) offers numerous benefits to participants. Firstly, it generates passive income through transaction fees charged to traders. Secondly, liquidity providers receive rewards in the form of native tokens or governance tokens, incentivizing them to maintain liquidity in the pool. Thirdly, liquidity provision contributes to the stability and efficiency of the pool, enhancing the overall ecosystem. Additionally, liquidity providers enjoy access to exclusive opportunities and airdrops, fostering a sense of community and loyalty. By participating in liquidity pools, individuals can not only earn rewards but also support the growth and development of the DeFi market.

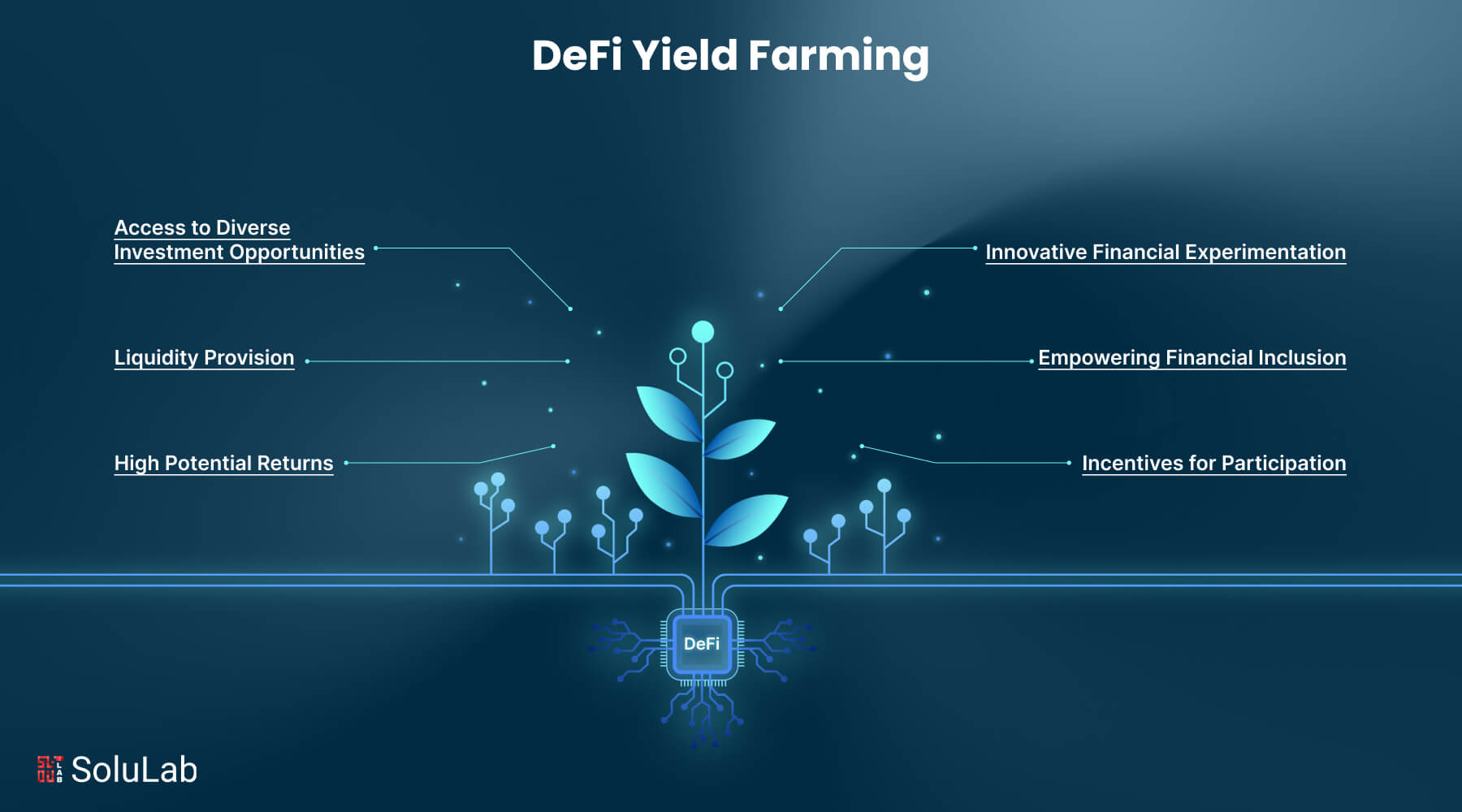

Yield Farming Explained

Yield farming is a cryptocurrency investment strategy that allows users to earn rewards by providing liquidity to decentralized finance (DeFi) protocols.

Steps involved include: depositing crypto assets into a liquidity pool, earning rewards in the form of platform tokens or fees, and compounding rewards to maximize returns.

Yield farming offers opportunities for investors looking to generate passive income while supporting the growth of DeFi ecosystems.

What is yield farming?

Yield farming is an innovative strategy in decentralized finance (DeFi) where users stake their crypto assets in liquidity pools to earn rewards.

By providing liquidity, users help facilitate trades and earn a portion of the transaction fees.

Yield farming often involves lending assets to a liquidity pool in exchange for interest payments or participating in automated market makers (AMMs) where users earn rewards based on the value of their assets in the pool.

Hope it is useful

In closing, the intricate ecosystem of DeFi and its liquidity pools has opened up unprecedented possibilities for individuals to actively participate in the financial markets.

By providing liquidity, users not only contribute to the smooth functioning of exchanges but also earn passive income through yield farming.

The concepts discussed in this article, such as liquidity pools, yield farming, and impermanent loss, equip investors with a comprehensive understanding of this innovative financial landscape.

As DeFi continues to evolve, we can anticipate even more groundbreaking applications and opportunities for wealth creation.

So, stay tuned for more enlightening articles on the fascinating world of cryptocurrency and finance.

Don’t forget to share this insightful piece with your friends, and thank you for your continued support.