Cryptomomen.com – In the burgeoning landscape of global finance, the advent of cryptocurrency has sparked a fervent debate, pitting it against fiat currencies. This dichotomy has fueled a chasm known as the “digital divide,” where conventional wisdom clashes with the enigmatic allure of blockchain technology.

Amidst the confusion and uncertainty, this article aims to unravel the intricate tapestry of crypto vs. fiat, illuminating the fundamental differences and similarities between these two divergent monetary paradigms.

By delving into the depths of their respective mechanisms, financial implications, and real-world applications, we will bridge the knowledge gap, empowering readers to make informed decisions. Continue reading to embark on an enlightening journey that will forever alter your understanding of the ever-evolving world of finance.

Introduction

Cryptocurrency, a digital asset that utilizes cryptography for secure transactions and control, has emerged as a potential alternative to traditional currency.

Unlike traditional currency, which relies on central authorities for issuance and regulation, cryptocurrency operates through decentralized networks, providing greater autonomy and reduced transaction costs.

However, the volatility and unpredictable nature of cryptocurrency prices, coupled with limited acceptance in mainstream markets, pose challenges to its widespread adoption.

Nonetheless, the potential benefits of cryptocurrency, including transparency, anonymity, and the ability to facilitate global transactions, continue to attract investors and enthusiasts.

Thank you for visiting Cryptomomen.com

Defining cryptocurrencies and fiat currencies

Cryptocurrencies, also known as digital currencies, are decentralized, digital mediums of exchange that utilize cryptography for security and operate independently of central authorities or banks.

Unlike fiat currencies, which are government-issued legal tender backed by the full faith and credit of the issuing government, cryptocurrencies are not legal tender and their value is determined by market forces.

While fiat currencies are centralized and regulated by central banks, cryptocurrencies operate on a decentralized network, often using blockchain technology, which provides a transparent and tamper-proof record of transactions.

Some common examples of cryptocurrencies include Bitcoin, Ethereum, and Litecoin, while examples of fiat currencies include the US dollar, Euro, and Japanese Yen.

Highlighting key differences between the two

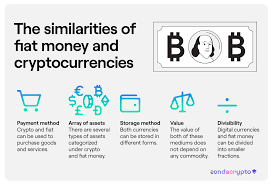

Cryptocurrency and traditional currency differ significantly in their decentralization, anonymity, and inflation control.

Traditional currencies are centralized, regulated by governments and central banks, and subject to inflation.

In contrast, cryptocurrencies are decentralized, operating on distributed ledger technology, and often have a limited supply or deflationary mechanisms to control inflation.

Furthermore, cryptocurrency transactions tend to be anonymous, while traditional currency transactions are traceable through financial institutions.

Understanding Cryptocurrencies

Understanding the nuances between cryptocurrencies and traditional currencies is paramount in navigating the financial landscape.

Unlike traditional currencies backed by central authorities, cryptocurrencies are decentralized, operating on blockchain technology.

They offer unique advantages, such as enhanced security due to encryption and distributed ledger systems.

However, cryptocurrencies also face challenges, including volatility and regulatory uncertainties.

Recognizing the distinctions between these two monetary systems empowers individuals to make informed decisions when engaging with digital assets.

Decentralization and blockchain technology

Decentralization and blockchain technology provide a revolutionary shift in currency management, empowering individuals with unprecedented control over their finances.

Unlike traditional currencies, which are centralized and subject to the whims of governments and financial institutions, decentralized cryptocurrencies operate on blockchain networks, essentially distributed ledgers that record transactions transparently and immutably.

This eliminates the need for intermediaries, reducing transaction costs, increasing security, and promoting greater financial inclusion.

By leveraging blockchain’s decentralized architecture, cryptocurrencies challenge the traditional monetary system, offering a more democratic and autonomous approach to finance.

Types of cryptocurrencies and their functions

Cryptocurrencies and traditional currencies exhibit distinct characteristics and functionalities.

Cryptocurrencies, such as Bitcoin and Ethereum, are decentralized digital assets that leverage blockchain technology to facilitate secure and transparent transactions.

Unlike traditional currencies, they operate independently of central banks and are not subject to inflation or government control.

Conversely, traditional currencies, like the US dollar or euro, are issued and regulated by central banks and serve as the primary medium of exchange within their respective jurisdictions.

While both types of currencies provide methods for financial transactions and value exchange, their underlying mechanisms and regulatory frameworks differ significantly.

Advantages and disadvantages of cryptocurrencies

Cryptocurrencies, decentralized digital currencies, offer advantages over traditional fiat currencies.

Their anonymity and borderless transactions empower individuals with financial autonomy.

However, cryptocurrencies face volatility and regulatory uncertainty.

Compared to traditional currencies, cryptocurrencies are decentralized, providing increased security and reducing the risk of manipulation.

However, their lack of regulation and high volatility pose significant challenges.

Investors should consider the advantages and disadvantages carefully before investing in cryptocurrencies.

Understanding Fiat Currencies

Understanding Fiat Currencies: Navigating the Complexities of Traditional and Cryptocurrencies

Fiat currencies, unlike traditional currencies such as gold or silver, derive their value solely from government decree and public trust.

They are not backed by any physical commodity but rather by the promise of the issuing government. This distinguishes them from cryptocurrencies, digital assets that utilize blockchain technology for secure transactions and typically operate independently of central authorities.

Cryptocurrencies often fluctuate in value based on supply and demand, while fiat currencies generally experience less volatility due to government regulation and widespread use. The choice between fiat currencies and cryptocurrencies presents investors with a complex decision, requiring careful consideration of factors such as stability, volatility, adoption rates, and regulatory frameworks.

Ultimately, the decision between fiat and crypto depends on individual risk tolerance and investment goals, highlighting the need for thorough research and informed decisions.

Centralized control and monetary policy

Centralized control over monetary policy poses significant challenges for cryptocurrencies.

Traditional currencies, on the other hand, benefit from the stability and regulation provided by central banks.

Cryptocurrencies lack a central authority to control their issuance and value, which can lead to extreme volatility and uncertainty.

This disparity highlights the fundamental differences between these two types of currencies, with traditional currencies offering greater stability but less autonomy, while cryptocurrencies prioritize decentralization but face challenges in maintaining monetary stability.

Role of financial institutions and government regulation

Financial institutions play a crucial role in managing the flow of money and providing essential services such as lending, savings, and investment.

They act as intermediaries between depositors and borrowers, facilitating the efficient allocation of capital and promoting economic growth.

In contrast, government regulation aims to protect consumers and maintain financial stability by establishing rules and guidelines for financial institutions.

This includes setting capital requirements, ensuring transparency, and preventing fraud.

By balancing these two perspectives, the coexistence of financial institutions and government regulation fosters a healthy financial system that supports both economic growth and investor confidence.

Hope it is useful

In conclusion, the debate between crypto and fiat currencies will likely continue as technology and financial regulations evolve.

While cryptocurrencies offer advantages such as decentralization, borderless transactions, and enhanced privacy, fiat currencies remain widely accepted and supported by central banks.

The choice between the two depends on individual preferences, risk tolerance, and investment goals.

As with any financial decision, it’s essential to conduct thorough research and consult with financial professionals to make informed choices.

So, until our next fascinating monetary adventure, stay curious and don’t forget to share this article with your fellow financial explorers.

A big thank you for joining us on this journey of demystifying the digital divide between crypto and fiat.