Definition of algorithmic stablecoins

Algorithmic stablecoins employ mathematical algorithms to maintain their peg to a fiat currency or other asset.

Unlike fiat-backed stablecoins, they do not require reserves of the underlying asset, but instead rely on a combination of market mechanisms and smart contract code.

By adjusting the supply of the stablecoin in response to market demand, algorithmic stablecoins aim to maintain a stable value.

However, they are vulnerable to market volatility and liquidity issues, and their stability ultimately depends on the stability of the underlying algorithm.

Thank you for visiting Cryptomomen.com

Mechanism for maintaining price stability

![What is price stability and why is it important? [+examples]](https://images.prismic.io/paddle/NzQyODcxNGMtZjdhMy00ZDdjLTgwOGUtNzg2NmVkNDJjYjA1_price20stability-01.jpg?auto=format,compress)

Central banks have traditionally employed interest rate adjustments, quantitative easing, and open market operations to maintain price stability in fiat currencies.

However, the emergence of cryptocurrencies has introduced new challenges and opportunities for price stabilization.

Algorithmic stablecoins, a type of cryptocurrency pegged to a stable asset such as the US dollar, have emerged as a potential solution to the price volatility often associated with cryptocurrencies.

These stablecoins use algorithms to adjust their supply in response to changes in demand, aiming to maintain a stable value.

Other mechanisms for cryptocurrency stability include stablecoins backed by fiat currencies or commodities, decentralized autonomous organizations (DAOs) that manage cryptocurrency reserves, and decentralized exchanges that facilitate efficient trading.

By leveraging these mechanisms, cryptocurrencies can enhance their stability and become more attractive to mainstream adoption.

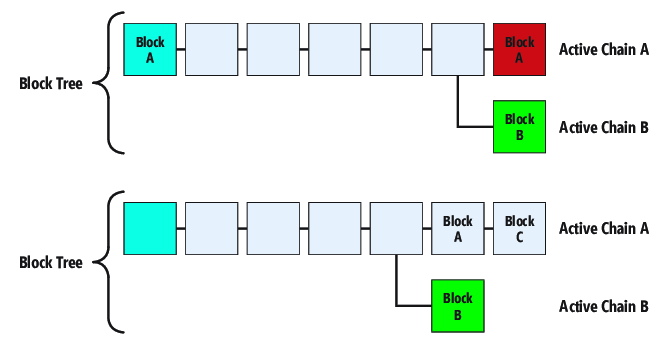

How Algorithmic Stablecoins Work

Algorithmic stablecoins maintain their value by relying on smart contracts and cryptoeconomic mechanisms rather than fiat currency reserves.

They use decentralized autonomous organizations (DAOs) to manage the supply and demand of the stablecoin, adjusting it in response to market conditions.

When the stablecoin’s value drops below the target, the DAO issues new coins, increasing the supply.

Conversely, if the value rises above the target, the DAO burns coins, reducing the supply.

By altering the supply dynamically, algorithmic stablecoins aim to maintain a stable value, free from peg risk.

Use of smart contracts

Applying smart contracts in cryptocurrency ecosystem offers notable advantages, such as enhancing the stability of algorithmic stablecoins.

These contracts automate the enforcement of predefined conditions, ensuring the peg of stablecoins to a reference asset (e.g., fiat currencies). Through the use of oracles and smart contract protocols, algorithmic stablecoins maintain their value even during market volatility, providing increased cryptocurrency stability.

Expansion and contraction of token supply

Algorithmic stablecoins adjust their token supply through algorithms to maintain their peg to a target asset, often a fiat currency like the US dollar. Expansion increases token supply when the price is above the peg, while contraction reduces it when the price is below the peg.

This mechanism aims to stabilize cryptocurrency stability by ensuring that the token supply adjusts to market demand, preventing excessive volatility.

FAQs:

- How does expansion work?

- When the price of the stablecoin rises above its peg, the algorithm mints new tokens, increasing the supply.

- How does contraction work?

- When the price falls below the peg, the algorithm burns tokens, decreasing the supply.

Maintaining Price Stability through Code

The stability of cryptocurrencies has been a key challenge for widespread adoption.

Algorithmic stablecoins have emerged as a potential solution, utilizing smart contracts to adjust the supply of coins in response to price fluctuations.

By maintaining a peg to a fiat currency or a basket of assets, these stablecoins aim to mitigate volatility and provide a more stable store of value.

However, the design and implementation of algorithmic stablecoins require careful consideration to prevent unintended consequences, such as liquidity crises or systemic risks.

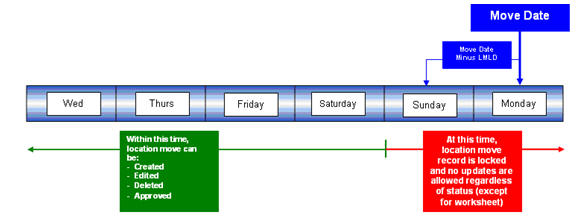

Oracle systems to determine market price

Oracle systems play a crucial role in determining the market price of algorithmic stablecoins, ensuring their stability within a volatile cryptocurrency landscape.

These systems serve as intermediaries, providing real-time data feeds that reflect the value of the underlying asset(s) or fiat currencies.

By utilizing decentralized oracles, stablecoins can maintain their peg to the target asset and minimize price fluctuations.

Adjustment algorithms to adjust token supply

Algorithmic stablecoins aim to maintain a stable value against a target asset through a combination of on-chain and off-chain mechanisms.

One of the key components of an algorithmic stablecoin is its adjustment algorithm, which adjusts the supply of tokens in circulation to counterbalance fluctuations in demand.

This process involves setting a target price for the stablecoin and using a feedback mechanism to increase or decrease supply as necessary.

For example, when the demand for the stablecoin increases, the adjustment algorithm can increase the supply by minting new tokens, which will lower the price.

Conversely, when demand decreases, the algorithm can decrease the supply by burning existing tokens, which will raise the price.

By constantly adjusting the supply, algorithmic stablecoins aim to maintain their stable value and mitigate short-term price fluctuations.

Thanks for reading

To conclude, algorithmic stablecoins offer a unique approach to maintaining cryptocurrency stability through innovative code-based mechanisms.

These stablecoins utilize algorithms to adjust their supply and demand, ensuring they maintain their target value.

While algorithmic stablecoins have experienced setbacks, advancements in technology and understanding continue to refine their design and implementation.

As the cryptocurrency market evolves, algorithmic stablecoins remain a fascinating concept, promising a decentralized and potentially more stable alternative to traditional fiat currencies.

With ongoing research and development, these innovative stablecoins hold the potential to revolutionize the way we perceive and interact with digital assets.

Thank you for joining us for this insightful exploration, and don’t forget to share this intriguing article with your curious friends and colleagues!