Cryptomomen.com – Embark on a transformative journey into the realm of Solana’s boundless potential. Delve into the intricacies of staking SOL tokens, a cornerstone of the Solana ecosystem.

This comprehensive guide empowers you to harness the full capabilities of this innovative blockchain, unlocking a world of opportunities for securing the network, earning passive rewards, and contributing to the vibrant community.

Immerse yourself in the fundamentals of staking, exploring strategies, best practices, and the potential returns it offers. Please continue reading to unlock the secrets of SOL token staking and unleash the transformative power of Solana.

Introduction

Solana (SOL) staking offers a compelling way to earn passive income while supporting the network’s security. Stakers deposit their SOL tokens into a staking pool and are rewarded with newly minted SOL based on the duration and amount of their stake.

The process is straightforward:

- Create a Solana wallet.

- Acquire SOL tokens.

- Choose a staking pool.

- Delegate your SOL to the pool.

Rewards are typically distributed daily and can vary depending on the pool’s performance. Staking SOL not only generates passive income, but also contributes to the network’s stability, as it encourages long-term holding of the token and reduces volatility.

Thank you for visiting Cryptomomen.com

Overview of Solana and its groundbreaking technology

Solana, a groundbreaking blockchain platform, revolutionizes the cryptocurrency landscape with its unparalleled speed, scalability, and cost-efficiency.

Its innovative Proof-of-History consensus mechanism enables transaction throughput of thousands per second, far exceeding that of traditional networks.

Users can leverage this high-speed network for lightning-fast transactions, efficient smart contracts, and decentralized applications.

Additionally, Solana offers a lucrative staking mechanism, allowing SOL holders to earn rewards by securing the network and validating transactions.

This staking feature provides a passive income stream while contributing to the stability and security of the Solana ecosystem.

Benefits of staking SOL tokens

SOL staking offers numerous benefits, including: passive income generation through transaction fees, support for the Solana network, and governance rights.

To stake SOL, follow these steps: create a Solana wallet, transfer SOL tokens to the wallet, choose a staking pool, and delegate your tokens to a validator.

The rewards earned from staking are proportional to the amount staked and the duration of staking.

Staking SOL Tokens

Solana (SOL) Staking involves locking SOL tokens in a secure wallet to validate transactions on the Solana blockchain network.

By staking SOL tokens, you contribute to network security and earn rewards proportional to your stake.

The process is designed to encourage participation in the network’s operation and incentivize token holders to contribute to its stability.

The rewards earned from staking SOL tokens can vary depending on the staking pool or validator you choose.

However, it typically provides a passive income stream for token holders and helps support the growth and adoption of the Solana ecosystem.

Different ways to stake SOL tokens

Solana (SOL) Staking offers a variety of methods to earn rewards. Delegated staking involves entrusting SOL tokens to a validator responsible for verifying transactions and maintaining network security.

Staking pools provide an alternative for smaller holders, allowing them to pool their SOL with others to increase staking rewards.

Non-custodial staking allows users to retain control of their SOL tokens while still earning rewards through platforms like Exodus and Trust Wallet.

To stake SOL, simply choose a method, transfer your tokens to the designated wallet or pool, and earn rewards proportional to your stake.

Choosing a staking pool or exchange

Deciding between a staking pool and an exchange for Solana (SOL) staking requires careful consideration.

Staking pools offer decentralized governance and lower fees, but require a minimum stake amount and lock-up period.

Exchanges provide convenience, flexibility, and often higher yields, but may impose custody fees and have centralized control.

Factors to evaluate include: * Security: Assess the reputation and track record of the platform.

- Fees: Compare transaction fees, staking fees, and withdrawal fees. * Minimum stake: Consider the required stake amount and whether it aligns with your investment strategy.

- Lock-up period: Determine whether the staking period aligns with your investment goals.

- Yields: Compare the estimated annual percentage yield (APY) offered by different platforms.

- Governance: Consider the level of control you desire over staking decisions.

Staking pools empower participants with voting rights, while exchanges typically manage staking operations centrally.

- Convenience: Evaluate the ease of use, accessibility, and customer support of each platform.

- Reputation: Research the background, experience, and community engagement of the platform.

- Insurance: Assess whether the platform offers insurance or guarantees for staked assets.

- Lock-up period: Determine whether the staking period aligns with your investment goals.

- Yields: Compare the estimated annual percentage yield (APY) offered by different platforms.

- Governance: Consider the level of control you desire over staking decisions.

Staking pools empower participants with voting rights, while exchanges typically manage staking operations centrally.

- Convenience: Evaluate the ease of use, accessibility, and customer support of each platform.

- Reputation: Research the background, experience, and community engagement of the platform.

- Insurance: Assess whether the platform offers insurance or guarantees for staked assets.

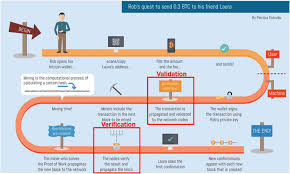

Understanding the Staking Process

Understanding the nuances of cryptocurrency staking, particularly Solana (SOL), is crucial for maximizing returns on digital assets.

Staking involves committing a certain amount of tokens to support the network and ensure its security, thereby earning passive income.

The process typically includes selecting a reliable staking pool or validator, depositing the desired amount of SOL, and monitoring the rewards accumulated over time.

By participating in the staking process, investors not only contribute to the stability and growth of the Solana ecosystem but also reap the benefits of earning additional SOL tokens.

Staking rewards and inflation

Staking rewards are earned by holding certain cryptocurrencies in a digital wallet and validating transactions on the blockchain.

Solana (SOL) is one such cryptocurrency that offers staking rewards. To stake SOL, users must create a staked account, which is an address on the Solana blockchain that is used to hold the staked SOL.

Once the account is created, users can transfer SOL to it and begin earning rewards.

The amount of rewards earned depends on the amount of SOL staked, the staking period, and the annual percentage yield (APY) offered by the staking pool.

It’s important to note that staking rewards are not guaranteed and may fluctuate based on market conditions and network activity.

Inflation is another important consideration for staked cryptocurrencies.

When new tokens are created through staking, it can increase the overall supply of the currency and potentially lead to inflationary pressures.

Unstaking and slashing penalties

When unstaking SOL, there is no mandatory lock-up period, but a 2-day cooldown period applies before the SOL can be withdrawn.

During this period, the unstaked SOL remains in the validator’s queue but does not earn any rewards. If a validator is found to be malicious or goes offline for an extended period, slashing penalties can be imposed.

These penalties involve the loss of staked SOL and validator rewards. To mitigate slashing risks, it is crucial to choose reputable validators with a proven track record of reliability and stability.

Hope it is useful

In conclusion, Solana staking presents an exceptional opportunity to earn passive income while supporting the growth of the Solana ecosystem.

By participating in staking, you contribute to the network’s security and stability, ensuring its long-term viability.

Whether you are a seasoned investor or a budding enthusiast, staking SOL tokens is a compelling way to maximize your cryptocurrency holdings.

As you continue your exploration of the blockchain world, remember to share this valuable information with your network.

Until next time, happy cryptocurrency adventures!