Understanding USDT

Understanding USDT: With the increasing popularity of cryptocurrencies, it’s crucial to grasp the fundamentals of stablecoins like USDT.

USDT is pegged to the US dollar, offering stability amidst market volatility. To withdraw USDT, select the Withdraw option on the exchange or platform, input the amount, and provide the recipient’s address.

For bank transfers, select the “Bank Transfer” option, enter the bank account details, and confirm the amount and withdrawal fee. Note that processing times and fees vary depending on the exchange or platform.

Thank you for visiting Cryptomomen.com

Benefits of Using USDT

Utilizing USDT (Tether) offers several benefits, particularly for cross-border transactions. Firstly, USDT is a stablecoin linked to the US dollar, providing stability and predictability in a volatile cryptocurrency market.

Secondly, USDT transactions are fast and efficient, often processed within minutes, making it convenient for seamless international payments.

Moreover, USDT enables bank transfers, allowing businesses and individuals to easily convert their holdings to fiat currency and vice versa, providing flexibility and accessibility in financial management.

Bridging USDT

To initiate a USDT withdrawal via bank transfer, follow these steps:

- Access your account: Visit the exchange platform and log in to your account.

- Navigate to Withdrawals: Locate the “Withdrawals” section and select it.

- Choose USDT and Bank Transfer: From the available withdrawal options, choose USDT and select the “Bank Transfer” method.

- Fill in your bank details: Enter the recipient’s bank account number, SWIFT code, and beneficiary name.

- Enter the USDT withdrawal amount: Specify the amount of USDT you wish to withdraw.

- Validate your withdrawal request: Review and confirm all the details before submitting your withdrawal request.

- Monitor your withdrawal: Once the withdrawal request is processed, you can check the transaction history or contact customer support to monitor its status.

Top USDT Bridges

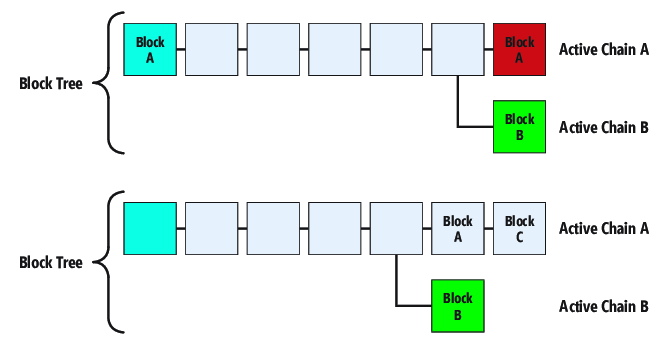

Tether (USDT) bridge services provide seamless cross-chain transfers and enable users to withdraw funds directly to their bank accounts. These bridges leverage blockchain infrastructure to connect different blockchains, allowing users to move USDT tokens across chains without hassle.

They offer competitive exchange rates, fast transaction times, and a user-friendly interface, making them an ideal solution for transferring USDT.

Whether you need to bridge tokens between different chains or withdraw funds to your bank account, using a reputable USDT bridge ensures a secure and efficient experience.

Withdrawing USDT to Bank Account

To withdraw USDT to a bank account, follow these steps:

- Navigate to the USDT withdrawal page on the exchange platform.

- Input the destination bank account details, including bank name, account number, and SWIFT code.

- Specify the amount of USDT you wish to withdraw.

- Review and confirm the withdrawal details to ensure accuracy.

- Authorize the transaction using the required verification methods (e.g., 2FA, email confirmation).

- The withdrawal process may take some time, depending on the processing time of the exchange and the receiving bank.

Fees and Regulations

USDT Withdrawal (TRC20): Minimum withdrawal amount is 20 USDT. Withdrawal fees are: 1 USDT for withdrawals below 1000 USDT, and 1.5% for withdrawals over 1000 USDT (minimum fee of 15 USDT). Bank Transfer (Swift): Minimum withdrawal amount is 100 USDT.

Withdrawal fees are: 5 USDT for withdrawals below 2000 USDT, and 0.5% for withdrawals over 2000 USDT (minimum fee of 10 USDT). Please note that additional intermediary bank fees may apply depending on the destination country.

Security Considerations

When withdrawing USDT, various security measures must be taken to ensure the transaction’s safety. Bank transfers, in particular, require additional precautions due to their potential for cyber-attacks.

To secure USDT withdrawals through bank transfers, it’s crucial to implement robust authentication mechanisms such as multi-factor authentication, employ anti-fraud systems to detect suspicious activities, monitor transaction histories for anomalies, and utilize encryption protocols to safeguard data during transmission.

Furthermore, partnering with reputable financial institutions and adhering to industry best practices can further enhance the security of USDT withdrawals via bank transfers.

Conclusion

Step 1: Withdrawal Request

Withdraw your desired amount of USDT from your exchange wallet. Select the “Withdraw” option, provide the recipient’s address, and confirm the transaction.

Step 2: Bank Transfer

Once the USDT withdrawal is processed, log in to your bank account. Go to the “International Wire Transfer” or “Bank Transfer” section. Enter the exchange’s bank details, the USDT amount, and your unique reference number (if provided by the exchange).

Step 3: Confirmation and Receipt

Verify the transfer details and confirm the transaction. The USDT will be deposited into your bank account within the timeframe specified by the exchange or intermediary (typically 1-3 business days). Note that additional fees may apply for international transfers. Keep the transaction receipt for any future reference or reconciliation.

Closing Words

With USDT withdrawal capabilities now fully integrated into the platform, you can effortlessly transfer your funds from the crypto realm to your traditional bank account.

This bank transfer feature empowers you to seamlessly bridge the gap between digital assets and fiat currency, providing you with unparalleled flexibility and control over your financial transactions.

Whether you’re seeking to cash out your profits, fund your everyday expenses, or simply diversify your portfolio, the USDT withdrawal option offers a convenient and secure solution.

Don’t miss out on this groundbreaking advancement, and stay tuned for more exciting updates. And with that, we bid farewell to another thought-provoking article. Remember to share this knowledge with your peers, and thank you for your continued readership.